Pitch: PriceSmart, Inc. (NasdaqGS:PSMT)

PSMT equity holders get paid to own a put on the U.S. Dollar

Disclaimer: this is not investment advice – do your own research.

Note: all data as of 5/23/2025

Executive Summary

PriceSmart, Inc. (NasdaqGS: PSMT) is a U.S.-based operator of membership warehouse clubs serving Latin America and the Caribbean. PSMT operates 54 membership-based warehouse clubs in 12 countries across Latin America and the Caribbean.

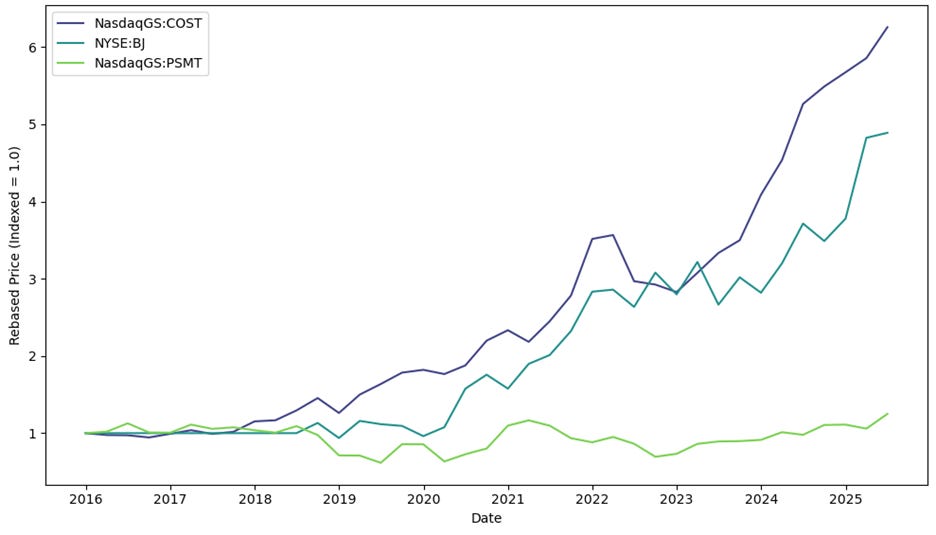

While U.S.-based warehouse clubs Costco and BJ’s have delivered phenomenal returns for investors, PSMT shares are essentially flat since 2015.

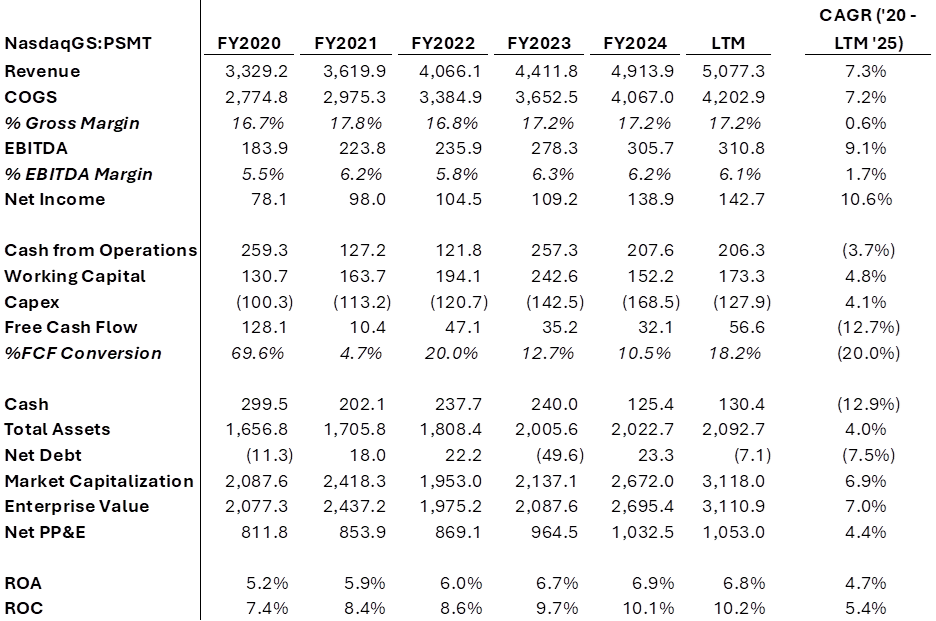

Since FY 2020, PSMT has grown revenues at a 7.3% CAGR and driven modest gross and EBITDA margin expansion. PSMT consistently generates positive free cash flow, carries no debt, and realized a 10.2% LTM return on capital.

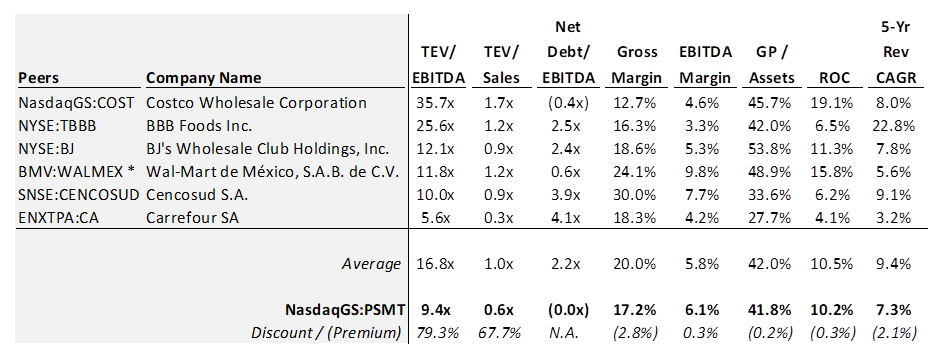

Relative to comparable peers, PSMT trades at a 79.3% discount on TEV/EBITDA and a 67.7% discount on TEV/Sales. PSMT has realized above-peer EBITDA margins, in-line returns on capital, but a 5-year trailing growth CAGR (2.1%) weaker than the peer average of 9.4%.

PSMT equity essentially functions as a short-dollar long-EM carry trade: both its operations and its debt are U.S. dollar-financed while it collects revenues in local market currencies. FX changes alone explain 20% of the variation in annual revenue growth and 25% of the variation in EBITDA margin expansion.

When local market currencies strengthen against the dollar, PSMT experiences an uplift in revenue, sees margin expansion, and tends to receive a higher market valuation from investors. I incorporate these drivers into a valuation framework to underwrite hypothetical outcomes in both weak and strong-dollar regimes.

In a weak-dollar regime, the combined impact of revenue growth, margin expansion, and multiple re-rating drives extreme right tail outcomes with a 10% probability investors realize more than 5x their principal over three years, but with increased risk to capital preservation. In a strong-dollar regime investors see downside protection and a 1.5x median multiple of money over three years, but overall little dispersion in realized potential outcomes.

Today, PSMT trades with a 1.2% dividend yield and offers a 1.8% free cash flow yield on equity. I see equity holders essentially getting paid to own a put on the U.S. dollar.

Business Overview & Industry

PriceSmart, Inc. (NasdaqGS: PSMT) is a U.S.-based operator of membership warehouse clubs serving Latin America and the Caribbean. The company was founded in 1996 by the Price family, the creators of Price Club, which merged with Costco in 1993. Today, PSMT operates 54 membership-based warehouse clubs in 12 countries across Latin America and the Caribbean. PSMT operates 10-stores in Colombia, 8 in Costa Rica, 7 in Panama, 6 in Guatemala, 5 in the Dominican Republic, 4 in both Trinidad and El Salvador, 3 in Honduras, 2 in both Nicaragua and Jamaica, and one in each of Aruba, Barbados, and the USVI. PSMT plans to open 2 additional stores in Costa Rica and Guatemala by year end 2025.

Importantly, PSMT’s buying operations are based in the U.S. As of 2018, some 60% of PSMT’s imports originated in China and largely routed through the firm’s Miami-based distribution center. When President Trump introduced tariffs during his first term, PSMT responded by building a 165,000sqft distribution center in Costa Rica, which was completed in 2019 and allows PSMT to ship directly into Central America and bypass U.S. tariffs. PSMT further developed ex-U.S. sourcing capabilities by building an additional distribution center in Panama, which completed in 2024, and the firm has now signaled intention to develop additional centers in Guatemala, Trinidad, and the Dominican Republic. In sum, PSMT has built out a robust supply chain that can manage high-volume imports with minimal risk.

PSMT is often referred to as the “Costco of Latin America”; it sells limited-selection high-volume inventory of groceries, fresh foods, appliances, and electronics at low margins to fee-paying members. In FY 2024, membership income was just 1.5% of net merchandise sales but amounted to 34.1% of total operating income. PSMT has roughly 2 million membership accounts and has frequently increased membership fees. Despite these price hikes, PSMT’s member renewal rate was 87.9% in FY 2024 and 86.9% in FY 2023. And while PSMT may be called the Costco of Latin America, its share price certainly hasn’t acted like it. Figure 1 shows evolution of PSMT share price since 2015 relative to Costco and fellow U.S. warehouse-club peer BJ’s Wholesale.

Figure 1: PSMT, COST, BJ Share Prices Indexed to 1, Quarterly 2015 – Present

Source: S&P Capital IQ

The data show that the club warehouse format has delivered exceptional returns for both Costco and BJ’s investors. PSMT, however, has essentially been dead money for the last decade.

Financials

PSMT is a financially strong company. Figure 2 shows select financial and operating metrics for PSMT from FY 2020 through the firm’s most recent earnings release. PSMT generated more than $5B in sales on an LTM basis and has grown revenues at a 7.3% average annual rate since FY 2020. Over this period, PSMT has driven both gross and EBITDA margin expansion. PSMT consistently generates positive cash from operations and realized $56.6M in free cash flow on an LTM basis. Historically the firm has used little debt and today carries net cash on the balance sheet. PSMT has driven consistent increases in returns on capital, which stand at 10.2% on an LTM basis.

Figure 2: Select PSMT Financials, FY 2020 – Present

Source: S&P Capital IQ

Peers

PSMT is the only major membership warehouse club operator in Central America and the Caribbean and faces very limited direct competition in its format, neither Costco nor Sam’s Club operate in its markets. There is some indirect competition from Walmart, who has a presence in the region. The main competitors, however, are local supermarkets and hypermarkets, which compete with PSMT but don’t provide the same bulk deals nor the level of variety in products that some users cite of PSMT. Per one reddit review, PSMT is known for certain specialty foods that cannot be found in other locations. While these smaller markets tend to generate lower $ throughput per store, PSMT can be the only game in town in places like Aruba. For island nations with expensive imports the PSMT format can offer a very attractive value proposition.

Relative to comparable warehouse club and hypermarket peers, PSMT trades at a 79.3% discount on TEV/EBITDA and a 67.7% discount on TEV/Sales. While the average peer is 2.2x levered, PSMT typically has little debt and today carries $7.1M in net cash. PSMT has realized returns on capital in-line with the average peer but has lower trailing growth on a 5-year basis.

Figure 3: PSMT Valuation and Operating Metrics vs. Comparable Peers

Source: S&P Capital IQ

Trailing financial and operating performance don’t offer a compelling explanation for the PSMT’s discounted valuation.

Risks

While PSMT faces limited format-specific competition in its core markets today, competitive pressures are likely to rise as these markets scale. Today, most markets are too small to attract large-format entrants like Sam’s Club, but that could change with continued growth. Anecdotally, some local corner stores appear to treat PSMT as a distributor; if these stores come under pressure, there could be upstream effects, though reliable data to quantify this risk is limited. PSMT also does operate a complex supply chain, which remains vulnerable to shifting geopolitical dynamics despite the firm’s recent investments in redundancy. Ultimately, the most pressing concern for investors is PSMT’s unhedged exposure to foreign currency fluctuations.

FX Exposure

Nearly 80% of PSMT’s sales occur in local currencies (i.e. the Colombian Peso) while the majority of the firm’s products are imported and priced in U.S. dollars. Typically, foreign exchange rate volatility has been a headwind for PSMT as the firm’s end markets are frequently disrupted by sudden currency devaluations. An extreme example of the impact that currency volatility can have on PSMT revenues occurred in 2014, when the Colombian Peso depreciated ~60% relative to the U.S. dollar, which translated to a (26%) decline in reported Colombia USD segment sales. PSMT essentially functions as a short-dollar long-EM carry trade.

To quantify the relative importance of FX volatility, I constructed a basket of USD-FX exchange rates weighted by PSMT’s end market exposures and regressed year-over-year changes in PSMT’s revenue growth, EBITDA margin, and TEV/sales multiple against this FX proxy on quarterly data going back to August 1995. Figure 4 shows that currency volatility explains a substantial portion of PSMT’s revenue growth and margin expansion. The first plot shows that FX changes alone explain 20% of the variation in annual revenue growth. Impressively, a 1% appreciation of local currencies relative to the U.S. dollar drives a 2.97% increase annual revenue growth. Similarly, FX changes explain up to 25% of the variance in EBITDA margins and the data show that a 1% increase in local currencies relative to the US dollar drives 0.57% in EBITDA margin expansion. Interestingly, the data show that FX changes do not directly explain variation in valuation at a quarterly frequency.

Figure 4: FX Impact on Revenue Growth, EBITDA Margins, and Valuation, Quarterly 1995 – Present

Source: S&P Capital IQ, Yahoo Finance, Countervail Analysis

Endnotes: [1], [2], [3]

While there is no clear direct link between FX changes and valuation levels, further analysis shows that PSMT valuation does respond to changes in fundamentals. Figure 5 captures this relationship. I created a composite metric to summarize how annual revenue growth and EBITDA margins jointly impact valuation levels. The data show that high growth and wide margins are associated with higher valuations. Specifically, when PSMT is experiencing top tercile revenue growth and margin expansion, the company trades with an average ~0.8x sales multiple. Conversely, when PSMT is experiencing bottom tercile revenue growth and margin contraction, the company trades with an average ~0.5x sales multiple. These valuation levels appear to coincide with different currency regimes: higher valuations are associated with strengthening local currencies, while lower valuations are associated with weaking local currencies.

Figure 5: PSMT Valuation Response to Changes in Fundamentals

Source: S&P Capital IQ, Yahoo Finance, Countervail Analysis

Endnotes: [4], [5]

In sum, FX changes influence valuation levels indirectly through their direct impact on underlying fundamentals. When local market currencies strengthen against the dollar, PSMT experiences an uplift in revenue, sees margin expansion, and as fundamentals improve, tends to receive a higher market valuation from investors. In this way, small currency fluctuations can amplify into substantial changes in equity value.

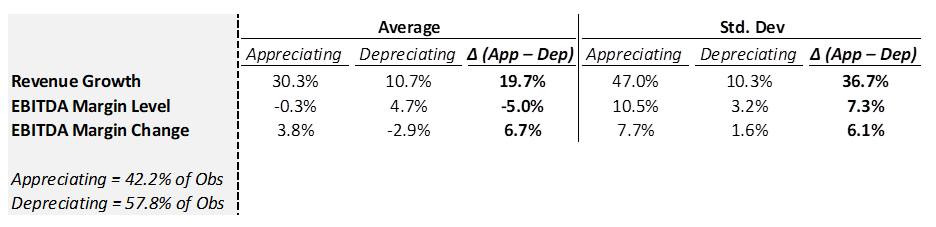

Valuation

To quantify the impact of these currency fluctuations for equity holders, I underwrite a range of outcomes under two regimes, one where the U.S. dollar strengthens against these local market currencies, and another where the opposite occurs. Data going back to August 1995 show that these two regimes have vastly different consequences for PSMT’s financials. Figure 6 captures the stark difference in PSMT’s financial performance depending on the prevailing FX regime. Historically, when local market currencies have strengthened against the U.S. dollar, PSMT has delivered average annual revenue growth of 30.3%, with flat but volatile and often expanding EBITDA margins. Conversely, during periods of local currency depreciation, revenue growth has slowed to an average of 10.7%, while EBITDA margins, though positive, have tended to contract.

Figure 6: PSMT Financial Performance by FX Regime, Quarterly 1995 – Present

Source: S&P Capital IQ, Yahoo Finance, Countervail Analysis

Endnote: [6]

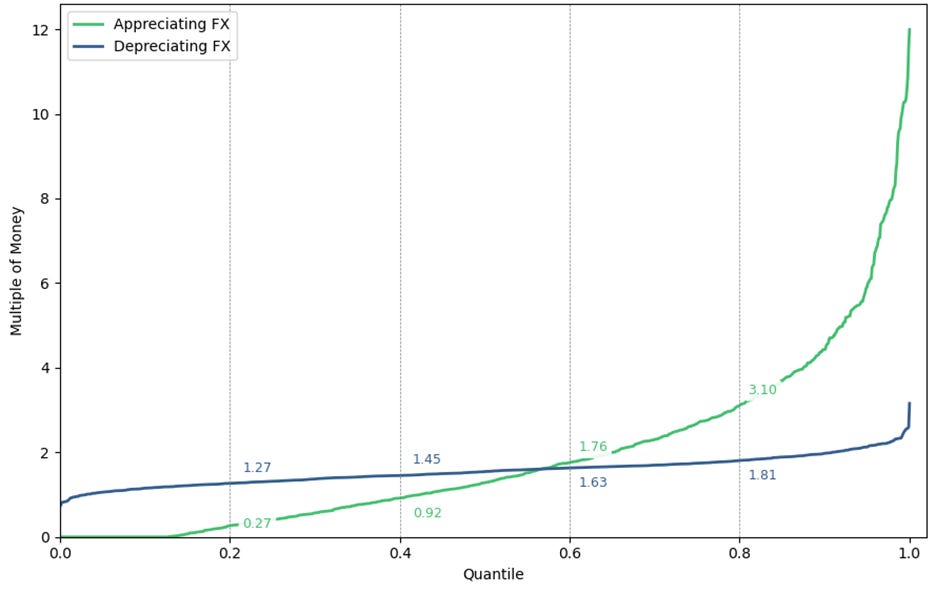

I used these average characteristics together with their standard deviations to generate a range of potential outcomes for equity holders, which are summarized in Figure 7. The green line shows the distribution of scenarios in a hypothetical world where local market currencies strengthen against the USD. Here the outcomes are much more volatile. Roughly 15% of outcomes result in full loss of capital, in the median scenario investors keep their principal, and in the most extreme scenario investors earn are shown earning up to 12x their investment. The far right-tail of outcomes here would be characterized by very extreme phenomena: significant USD devaluation, extreme revenue growth, and substantial margin and multiple expansion. The blue line shows a much more boring set of outcomes. Here the data show the distribution of potential outcomes when the USD strengthens against the local market currencies. Fluctuations in revenue growth, margins, and the valuation multiple are quite muted. Simulations show no bankruptcy risk and even limited risk to principal, but upside is also limited.

Figure 7: Range of PSMT Multiple of Money Scenarios by FX Regime (Appreciating vs. Depreciating)

Source: S&P Capital IQ, Yahoo Finance, Countervail Analysis

Endnotes: [7]

Figure 8 shows PSMT TEV/ sales multiple since 2015. Today, PSMT is trading 0.6x revenues, which is near a 10-year low and would typically correspond with strong dollar regimes. Year-to-date, however, the broad dollar index has depreciated some (10%). The current valuation would appear misaligned with a history that tends to eventually associate a weakening dollar with bullish prospects for PSMT.

Figure 8: PSMT TEV/Sales, 2015 – Present

Source: S&P Capital IQ

It’s very difficult to know where FX rates will head going forward, but in a scenario where the U.S. dollar depreciates even modestly, the analysis I present here suggests high potential for a bullwhip that drives an uplift in revenue growth, margin expansion, and a subsequent re-rate in the multiple. Today, PSMT trades with a 1.2% dividend yield and offers a 1.8% free cash flow yield on equity. In aggregate, I see equity holders essentially getting paid to own a put on U.S. dollar depreciation, which remains a lingering concern given ongoing policy volatility. In my mind, one should have to pay a premium to bet on this type of outcome – insurance should not be costless! It’s rare to see a positive-carry hedge trading at a discount. I have built PSMT into a core position in my fund.

Summary

PSMT is a club warehouse operator focused on Latin American and Caribbean economies, where markets are smaller but face limited competition. Today PSMT trades at a steep discount both relative to its comparable peers and to its own history. PSMT equity holders bear substantial foreign exchange risk; PSMT does not hedge currency exposure, and the equity resembles a short-dollar carry trade. PSMT realizes wildly different results depending on the prevailing currency regime and equity holders benefit immensely when local currencies strengthen against the dollar. Today, I believe PSMT valuation does not adequately reflect the possibility of even moderate U.S. dollar weakness, which could generate substantial gains for PSMT equity holders through this channel’s leverage on revenue growth, EBITDA margins, and ultimately valuation multiples. If the U.S. dollar does not weaken, equity holders still own a company that has realized GDP+ growth, delivered margin expansion, has no debt, has realized attractive returns on capital, is well-stewarded by management and trades at a 10-year low on valuation.